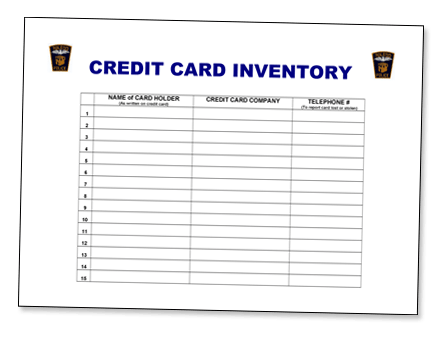

It is imperative that you report the loss or theft of your credit cards, ATM cards, or debit cards to the card issuer as soon as you become aware of loss, theft, or misuse of your account information.

Many companies have toll-free numbers and 24-hour service to deal with such emergencies. This form will provide you with easy access to the necessary information should you need to notify your card issuer. It will also prove useful if you need to file a police report or an insurance claim.

CLICK HERE to download our Credit Card Inventory Form.

Here are a few other tips regarding your credit cards:

- Limit the number of cards you possess. Only carry those cards that you use regularly. Keep the other cards secure and well hidden in your residence.

- Shred your credit card statements and any other paperwork that contains information regarding your personal identity before putting it in the trash.

- When making online purchases, adhere to the following tips to protect yourself and your identity when shopping online:

- Try to use the same credit card for all online purchases so if it is stolen, you will only have to deal with one credit card company.

- Don’t use debit cards for online purchases—credit cards typically offer better protections to the consumer.

- Don’t save credit card information on shopping sites. While this may speed up the process, it puts you at greater risk for fraud and theft.

- Change your passwords regularly. Use a combination of letters, numbers, symbols, and capital letters to make yourself less vulnerable to theft.

- Don’t use public Wi-Fi sites to make online purchases.

- Shop on reputable sites. Look for the https:// when entering personal information. Also look for the padlock symbol on the bottom of the browser window.